What You Need To Know About COVID-19 Billing

Many ClaimCare clients have reached out to us with numerous questions regarding billing during the COVID-19 crisis. They have also asked what other services we can provide to help them during this time. As a 100% USA-based medical billing and coding company, we feel it is the right thing to do to assist other medical practices and facilities in navigating rough waters during this flood of change.

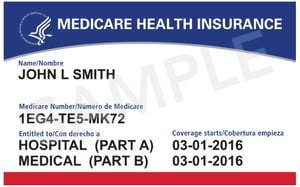

Here is the most recent key point ClaimCare has shared with clients: Medicare has made it much easier to bill for telemedicine (see below for details) – AND – Medicare has indicated that telemedicine payments will now be the same as the normal E&M visits.

As you are aware, information seemingly changes hourly regarding the Coronavirus. Therefore, we would like to update you on changes that have been implemented by the Federal Government to enable providers to care for patients, keep your doors open (even if virtually), and get paid for your efforts during the next several weeks or months. ClaimCare has also reminded clients they should not feel any immediate financial difficulties for the next few weeks, because the payments coming in now are from last month’s services and old AR work.

It is evident that practices must be available to patients to ensure continuity of care, as well as to ensure the financial health of the practices. Therefore, ClaimCare has assured clients we are in this together. We have assured clients we are partners in Revenue Cycle Management, but we can go much further than that. At the request of numerous clients, we are expanding our services to help those who may be finding themselves short-staffed or with a staff that has been quarantined and unable to work. But first, let’s look at telemedicine:

GUIDANCE FOR GETTING STARTED WITH TELEMEDICINE

GUIDANCE FOR GETTING STARTED WITH TELEMEDICINE

- How do I get started with providing telemedicine? The basic answer is that you pick up the phone. You do not have to be approved to provide this service, and you certainly do not have to change anything in your office. Just have access to your systems.

- We recommend you start with patients ALREADY on your schedule. Have your staff contact those patients and inform them that rather than coming into the office, they will be receiving a call from the provider. When that happens, you are doing telemedicine.

- If you have patients calling into your office requesting to be seen or to speak with a provider, schedule them in your appointment scheduler as you normally would. This will help you keep track of the patients you are billing for the service, and will also help you keep track of anyone who needs a call back or anyone who did not answer when you called earlier in the day.

- Your patients will appreciate the fact that you can still help them even though they cannot come into the office.

- You must obtain a verbal authorization from the patient at the beginning of the conversation.

- You should document the start and stop times of the call.

- When at all possible, we recommend you have an appointment type named “Telemedicine,” which is critical due to the similarity in coding as you will see below.

- You should review symptoms, review systems and conduct medication reconciliation as you would do if the patient was in the office.

- Be prepared for the need to refer patients for any kind of radiology, lab testing or COVID-19 testing. This includes telling them where to go, what to expect, and when they should receive results.

- Encourage the patients to sign up for your portal if they have not already done so. This will ensure that you can communicate with your patients even if it is just questions, test results and other capabilities that each system portal allows between the patient and the practice.

- Go ahead and schedule a follow-up for your patient. Explain that in these uncertain times it may be an office visit, or if the crisis is not over, you will call the patient again.

- Allow the patient to ask you questions. Don’t rush too much. The patient may be feeling anxious due to being confined to home and needs the reassurance that you and your staff care.

- If you have staff who can get on the phone and do some of these steps prior to the provider getting on the phone, we encourage you to do that. This will allow you to have your staff screening calls and placing them on hold while waiting for the doctor, just as if they were in your office.

- Remember, you can bill for your services! This is not providing services for free!

- As of March 20th, Medicare and other private sector payers are accepting traditional E&M codes for services rendered. The only difference in the CPT codes or E&M Codes will be the modifier that has to accompany the CPT Code, along with the Place of Service. Medicare has indicated the modifiers will NOT lower the payment of this visit. Phone visits pay at the same level as in-office visits. The ClaimCare team has worked to get phone visits added to our clients’ systems.

- You no longer need to divide videoconferencing from Telephonic visits. ALL will be processed by the payer, using the standard E&M codes 99212-99215.

- Keep in mind, you are not expected to be perfect! More than likely, this will be the FIRST time most patients have had a “virtual” visit. So, just breathe. Remember… to the patient you are the voice of reason and comfort!

WHAT CLAIMCARE CAN DO TO HELP

Several years ago, as a result of ClaimCare employees coming to work with the flu and infecting others, we spent significant time, energy and money to put into place a fully-tested, HIPAA-compliant, 100% USA-based work-from-home infrastructure. Doing that back then, has allowed us to seamlessly go fully remote as soon as the COVID-19 crisis was announced, continuing to serve clients in a timely and responsible manner.

We admire the USA industries that are currently making changes by re-engineering their services and factories to help address the COVID-19 needs of the country. As a proud 100% USA-based company, we are in a great position to adjust to address these same needs! Thus, along with medical billing and coding, we are offering some new services to assist our clients during the current crisis. We can:

- Contact your patients to alert those who are not on your scheduler that telemedicine is now an option.

- Assist with scheduling new telemedicine visits if your scheduling staff cannot make it into the office.

- Take over insurance verification and preauthorizations.

- Step up to the plate for clients who have asked us only to perform clean-up projects, but now realize they can’t keep up with the current billing and follow-up!

And, considering our solid position during these disturbing times, you may want to contact us regarding a need that is not on the above list. We will listen and will look for creative, innovative solutions.

ClaimCare has the resources, the manpower, and the experience to assist you in many ways. We realize that many practices are considering layoffs or even closing until this is over. We hope to help you avoid those options. Keep in mind that since the ClaimCare team is not seeing a disruption during this crisis, we are still getting our clients’ claims to the payers and collecting money for clients.

Important: With a Reuters Poll reporting on March 24, “India’s already-slowing economy weakened to at least an eight-year low this quarter and will slow even more sharply in the next six months due to the global coronavirus pandemic,” and Prime Minister Narendra Modi announcing a nationwide lockdown, ClaimCare is positioned to serve those who have been dependent upon India’s medical billers.

About ClaimCare

ClaimCare is a 100% USA-based HIPAA-Compliant Medical Billing Company

ClaimCare has once again been named a “Top 10 Medical Billing and Coding Company.” The honor this time comes from MD Tech Review. The magazine’s Augmenting Medical Billing and Coding Operations article presents solid reasons why ClaimCare has been chosen for this 2019-2020 recognition.

For additional information, contact sales@claimcare.net, or phone toll-free (855) 376-7631, or visit the ClaimCare Medical Billing website. We can assist your practice and/or facility in numerous ways.

Tags: medical billing companies, coronavirus, COVID-19, telemedicine

Any medical billing company offering multiple services, combined with Merit-based Incentive Payment System (MIPS) consultation, should be Health Insurance Portability and Accountability Act (HIPAA) compliant, especially when handling patient records and Protective Health Information (PHI). This is a must, as Electronic Health Records (EHRs) contain sensitive data that requires protection.

Any medical billing company offering multiple services, combined with Merit-based Incentive Payment System (MIPS) consultation, should be Health Insurance Portability and Accountability Act (HIPAA) compliant, especially when handling patient records and Protective Health Information (PHI). This is a must, as Electronic Health Records (EHRs) contain sensitive data that requires protection.

ClaimCare Medical Billing, 100% USA-based, has once again been named a ‘Top 10 Medical Billing and Coding Company.’ The honor this time comes from MD Tech Review. The magazine’s

ClaimCare Medical Billing, 100% USA-based, has once again been named a ‘Top 10 Medical Billing and Coding Company.’ The honor this time comes from MD Tech Review. The magazine’s  Do you know that “surveys consistently demonstrate that patients prioritize both the interpersonal attributes of their providers and their individual relationships with providers above all else?” This is the statement made by Kurt Strange, an expert in family and health systems in one of the articles published in

Do you know that “surveys consistently demonstrate that patients prioritize both the interpersonal attributes of their providers and their individual relationships with providers above all else?” This is the statement made by Kurt Strange, an expert in family and health systems in one of the articles published in

Medical billing reports are important in evaluating the efficiency of your practice. Thus, reports should show the performance of your organization in full details. This will greatly help in improving your revenue cycle.

Medical billing reports are important in evaluating the efficiency of your practice. Thus, reports should show the performance of your organization in full details. This will greatly help in improving your revenue cycle. Looking back, to look ahead: With ICD-11 on the horizon for 2022,

Looking back, to look ahead: With ICD-11 on the horizon for 2022,  The famous Chinese philosopher Confucius once said, "A man who does not plan long ahead will find trouble at his door." This is true, especially with healthcare providers in the U.S. and their physician credentialing process.

The famous Chinese philosopher Confucius once said, "A man who does not plan long ahead will find trouble at his door." This is true, especially with healthcare providers in the U.S. and their physician credentialing process.